Personal Income Taxes - Biello/Clarke

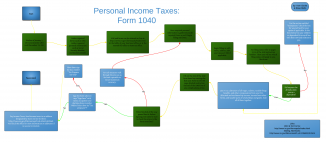

Lucid Chart HERE -- PIC BELOW --

Kern and I decided to file our personal income taxes as our bureaucratic 'task'. Doing your taxes is a pretty involved process; that's why most people usually have accountants do it or use online software to speed up the process at home. But, there are multiple steps to doing your taxes and many forms to fill out. In fact, the instruction manual on how to fill out 1 of the forms is over 160 pages long. First, you must gather all of your personal files and tax records; such as income sheets and other pieces. Then you use your W-2 and 1099 to fill out the 1040. The paperwork(1040) that we had to fill out was slightly straightforward and easy at parts, but definitely had parts that were pretty difficult to decipher.

When doing taxes, you must be very careful to not make any mistakes; because these mistakes could have severe consequences - such as being audited by the IRS. Overall, the paperwork was pretty easy to fill out using the give W-2; it's basically just simple math. If I could change one thing I would probably change the payment you have to make to file them. I believe the systems have become so complicated to ensure that there is no mistake and that 100% of all the information is accounted for. The government wants to know how much money is around and how much each person makes, so multi-step, complicated forms like the 1040 must be completed to show all information. Overall, doing your taxes is definitely easy if you file them using an online service, like TurboTax; but if that ever becomes unavailable, it's good to know that I know how to file my own taxes.

Kern and I decided to file our personal income taxes as our bureaucratic 'task'. Doing your taxes is a pretty involved process; that's why most people usually have accountants do it or use online software to speed up the process at home. But, there are multiple steps to doing your taxes and many forms to fill out. In fact, the instruction manual on how to fill out 1 of the forms is over 160 pages long. First, you must gather all of your personal files and tax records; such as income sheets and other pieces. Then you use your W-2 and 1099 to fill out the 1040. The paperwork(1040) that we had to fill out was slightly straightforward and easy at parts, but definitely had parts that were pretty difficult to decipher.

When doing taxes, you must be very careful to not make any mistakes; because these mistakes could have severe consequences - such as being audited by the IRS. Overall, the paperwork was pretty easy to fill out using the give W-2; it's basically just simple math. If I could change one thing I would probably change the payment you have to make to file them. I believe the systems have become so complicated to ensure that there is no mistake and that 100% of all the information is accounted for. The government wants to know how much money is around and how much each person makes, so multi-step, complicated forms like the 1040 must be completed to show all information. Overall, doing your taxes is definitely easy if you file them using an online service, like TurboTax; but if that ever becomes unavailable, it's good to know that I know how to file my own taxes.

Comments

No comments have been posted yet.

Log in to post a comment.